New Homes For Fifth Ward

HCD is partnering with the Houston Land Bank (HLB) to develop decent, safe, and affordable homes through our New Home Development Program (NHDP). Mayberry Homes will be constructing homes in the neighborhood. More information on the builder and their plans can be found below.

Through the NHDP, families will receive up to a $50,000 subsidy for down payment assistance, subsidized interest rates, reasonable closing costs, and mortgage principal reduction.

One of Houston's original six wards, the site was sparsely inhabited before the Civil War. It was subsequently settled by freedmen and became known as the Fifth Ward in 1866. Mount Vernon United Methodist Church, founded in 1865 by former slave Rev. Toby Gregg, is the oldest institution in the ward. Five other churches in Fifth Ward are over 100 years old. In the 1880s, the community enjoyed a boom following the construction of repair shops for the newly built Southern Pacific Railroad..

In the 1990s and 2000s, the area saw significant housing and commercial growth as the Fifth Ward Community Redevelopment Corporation worked to revitalize the neighborhood through new home construction and increased focus on job training, access to technology, and access to the arts. A cultural arts festival celebrates the area's artistic, culinary, and musical heritage.

Please visit the Super Neighborhood 55 – Greater Fifth Ward page to learn more.

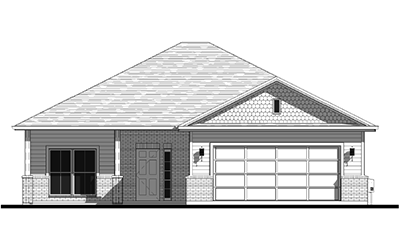

Mayberry Homes, Inc. has been committed for many years to revitalizing the heart of Houston, one home at a time.

We focus on making homeownership a reality for all individuals by providing quality new homes at an exceptional value to our clients. Therefore, our goal is to reach out to low and moderate-income families in the community. We share in the city’s effort to remove blight in the neighborhoods where we were raised and continue living.

Through your vision and our expertise, allow Mayberry Homes to become the builder of your choice in conceptualizing your dream home.

About the New Home Development Program

Key Facts

HCD aims to provide newly constructed, affordable single-family homes for Low-Moderate Income Homebuyers.

Properties are located in Acres Home, Settegast, Sunnyside, Fifth Ward, and Third Ward.

Household income must be below 80% of Area Median Income (Español) .

Frequently Asked Questions - Applicants

Q: How do I buy a home? - Answer

A: If you see a NHDP home you are interested in, please contact the Houston Land Bank for assistance. They can be contacted by phone at 281-655-4600 or by email at info@houstonlandbank.org.

Q: Is there an affordability period or secondary lien on the home? - Answer

A: You must reside in the home as your primary residence. Depending on the amount of subsidy you receive, the affordability period fluctuates (see chart below). There will be a lien placed on the property to secure the NHDP Loan.

| Amount of Assistance | Length of Lien | Annual Reduction Rate* |

|---|---|---|

| Less than $20,000 | 2.5 Years | 40% |

| $20,001 - $40,000 | 5 Years | 20% |

| $40,001 - $50,000 | 10 Years | 10% |

| $50,001 and above | 15 Years | 6.67% |

Q: How much subsidy can I recieve? - Answer

A: You could receive up to $50,000 in subsidy, based on your household financial need.

Q: Is there a maximum amount of liquid assets I can have? - Answer

A: You must have less than $30,000 in liquid assets at the time of eligibility determination and at closing.

Q: Do I have to be a U.S. Citizen? - Answer

A: The Applicant, Co-Applicant, and Spouse must be U.S. Citizens or a permanent resident.

Q: Can I purchase a NHDP home if I have previously owned a home? - Answer

A: You must be a first-time homebuyer to participate in this program.

Q: How long does the process take? - Answer

A: The eligibility process can take up to six weeks, provided there are no external delays. Please note that the six weeks are measured from the time the applicant submits a complete application. We cannot begin work on an incomplete application.

Q: What if I must sell my home or move out before my affordability period is over? - Answer

A: In these cases, the City will collect a portion of the investment made, proportional to the amount of time remaining in the residency period. To begin this process, please submit this Payoff Statement Request form to HCDDLoanServicing@houstontx.gov.

Q: Are there any fees associated with the program? - Answer

A: The buyer must contribute a minimum of $350 towards the transaction, which could be the inspection, down payment, appraisal, etc., but no fees are paid to the City of Houston. If someone tells you that there are participation fees, please report them for fraud .

Q: Are credit reports required for all household adults? - Answer

A: No. All household income must be reported, but only the loan applicant’s credit is reviewed during underwriting.

Q: Is there a credit score requirement? - Answer

A: No, the Homebuyer Assistance Program does not consider credit score.

Q: What can the assistance provided be used for? - Answer

A: The assistance CAN be used for:

- Down-payment

- Pre-paid items (homeowner’s insurance, mortgage interest, property taxes, etc.)

- Subsidize mortgage interest rate

- Reduce principal amount of first mortgage payment

- Reasonable closing costs

The assistance CANNOT be used for:

- Realtor’s commissions

Q: What if I need to refinance my home? - Answer

A: If your mortgage information changes, you will need to share the new information with our department. Please submit this Subordination Agreement Request to HCDDLoanServicing@houstontx.gov.

FAQs - Real Estate and Lending Professionals

Q: Does this program follow FHA guidelines? - Answer

A: No. The Single Family Eligibility sets and follows its own internal guidelines. Our underwriting includes calculating debt-to-income ratio, ensuring that there are no outstanding collections for government services or utilities, and verifying that there are no defaulted student loans.

Q: Is there a mandatory training that lenders and realtors must take to participate in the program? - Answer

A: No. Any lenders and realtors may participate. However, we do encourage realtors and lenders to view our workshop replay video on YouTube for additional information and to gain knowledge of the program.

Q: Who is the loan servicer? - Answer

A: HCD’s programs are serviced internally with our Loan Servicing Division. The loan is not amortized; however, there is a 6% fee applied to the defaulted loan balance.

Q: Can the program funds be used to pay realtor commissions? - Answer

A: No, the funds are strictly for down payment, closing costs, pre-paid items, and principal reduction. Should the buyer choose to pay a realtor commission, they will have to do so from their personal funds.